Dental

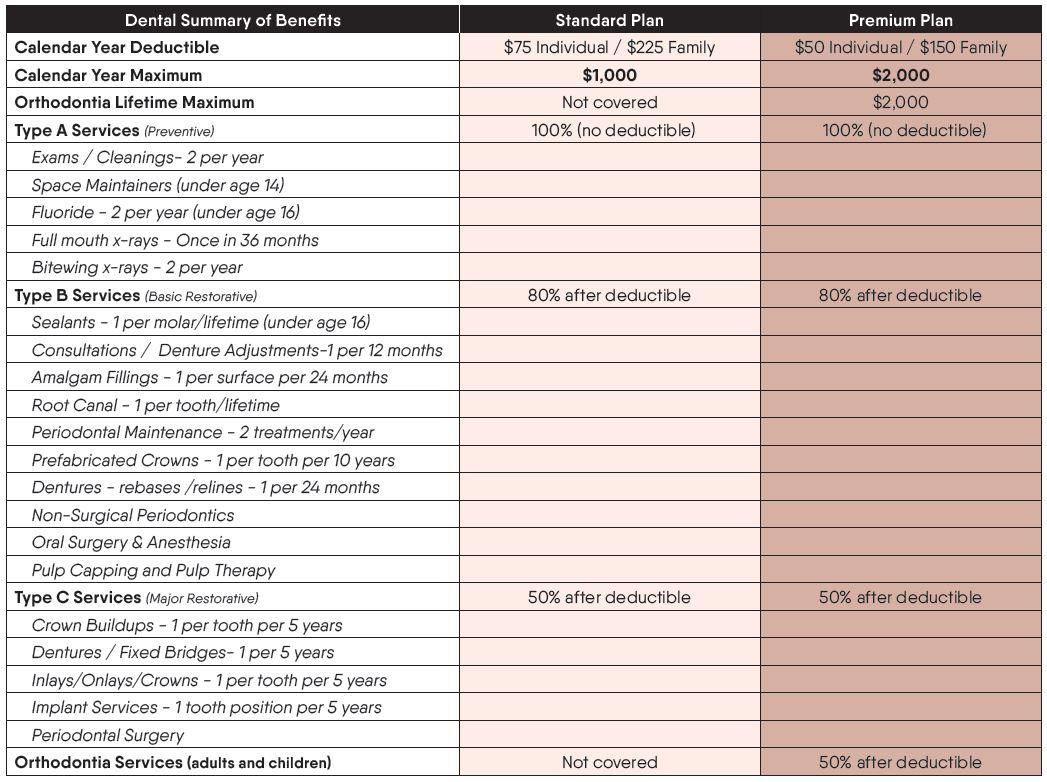

Baldwin County Schools offers two dental PPO plan options: the Standard Plan and the Premium Plan. Both plan options include preventive care at 100% with no deductible. The Standard Plan has the lowest premiums and a lower annual maximum benefit and does not include orthodontic care coverage. The Premium Plan has higher premiums, a higher annual maximum benefit, and includes coverage for orthodontic care. Dependent children can be covered up to age 26.

The MetLife dental plan options provide coverage both in and out-of-network. However, you will make the most of your dental plan benefits if you visit participating MetLife PDP Plus dentists. To reduce your out-of-pocket costs and prevent balance billing, you are encouraged to use in-network dentists. Visit www.metlife.com/dental to locate participating dentists. Select “PDP Plus” dental network. You can also download the mobile app to view plan information, find a provider, or view your ID card.

Below is a benefit summary of your annual deductible and co-insurance costs.

Summary of Benefits

Important Notes

-

Deductible (waived for preventive); differing annual maximums depending on plan

-

Members utilizing MetLife participating dentists will enjoy discounted dental fees in addition to protection from balance billing for charges above the dentist’s maximum allowable charges. Members utilizing non-participating dentists will have the same benefits, but may be subject to balance billing.

Claims Process

In-Network

- Participating MetLife dentists file the claim and accept payment from MetLife

- Employees should not need to pay at the time of service for participating providers

Out-of-Network

- For out-of-network dentists, if the dentist does not agree to file the claim as out-of-network with MetLife, employee pays at the time of service and files a claim for reimbursement

- Charges by out-of-network providers that exceed Usual & Customary are the member’s financial responsibility. (Member pays the difference between the actual charge and the plan’s U&C reimbursement level.)